INTEGRATED REPORT 2019

Variable pay long-term incentive

LTI cash plan

Airports Company South Africa operates an LTI plan that is cash-settled and based on the financial and non-financial growth of the Group. The LTI cash plan aims to align the Shareholder’s Compact with the Group Vision and 2025 strategy (refer to page 118) and individual performance to grow the business sustainably over the long term. The primary purpose of the LTI cash plan is to:

- Incentivise eligible employees to achieve the long-term objectives of our strategy and corporate plan

- Stimulate eligible employees to achieve sustainable performance, instil a culture of performance excellence and grow the business

- Align the Shareholder’s Compact to eligible employee performance objectives

- Reward eligible employees for significant discretionary efforts and achievements within their performance areas

Incentivise eligible employees to achieve the long-term objectives of our strategy and corporate plan Stimulate eligible employees to achieve sustainable performance, instil a culture of performance excellence and grow the business Align the Shareholder’s Compact to eligible employee performance objectives Reward eligible employees for significant discretionary efforts and achievements within their performance areas

The LTI cash plan is based on the following principles:

Eligibility to participate

The LTI rules provide for Board discretion and approval in the participation of executives in the LTI cash plan. The Board is responsible for approving all award allocations, considering the grade, individual performance and the length of service of an individual. The employee must have demonstrated consistent performance and have received a performance rating which exceeds a rating of 3 in the previous performance management cycle.

Award allocation

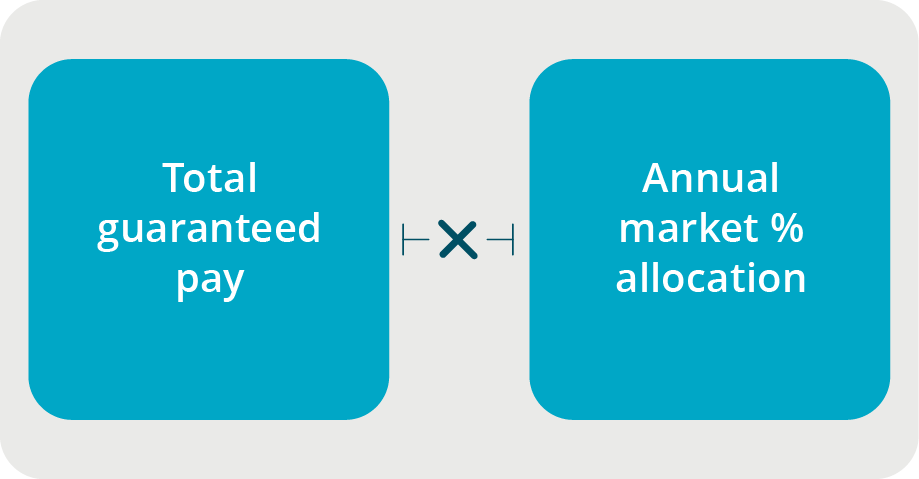

The LTI is awarded annually in line with the allocation terms and conditions, and is allocated according to the expected value based on the following calculation:

The annual market percentage allocation is the on-target percentage of an employee’s total guaranteed pay which will be used to determine the allocation value of the LTI award. This percentage will be dependent on the employee’s grade, which is determined by the Board from time to time based on, inter alia, the prevailing market trends. The Board has the discretion to apply a multiple to the allocation if they determine that annual allocations will not be made, to recognise a quantum appropriate for more infrequent awards. However, this is not currently applied, as annual allocations are made.

Performance assessment and vesting

For each performance condition, at the point of assessment, the achievement percentage will be determined with reference to the table below:

| Performance target | Achievement % |

|---|---|

|

Threshold Target Stretch |

30 100 125 |

Board discretion in final payments

The Board has ultimate discretion in the payment of any LTI awards. This includes the ability to reduce, remove and/or defer LTI award payments. Factors considered by the Board in the application of its discretion include, but are not limited to:

- The Group being in a cash-negative position

- Fulfilment of the free cash flow condition

- Malus and clawback provisions

- A qualified audit opinion

- If the payment would result in the breaching of debt covenants

The LTI cash plan aligns with the Shareholder’s Compact to instil a culture of performance excellence and growth sustainably over the long term.

| Position grade | Position eligible | On-target LTI (% OF TOTAL GUARANTEED PAY) |

|---|---|---|

| F3 | CEO | 60 |

| F2 | CFO | 50 |

| F1 | COO | 50 |

| EU | Group executives | 30 |

| EL | Airport general managers only | 25 |

The applicable financial and non-financial performance conditions for the FY2020 awards are outlined below:

| Performance measure | Threshold (% vesting) | Target (% vesting) | Stretch (% vesting) | |

|---|---|---|---|---|

| Financial performance conditions (60% weighting) |

ROE (30% weighting) | ROE | ROE + 2-3% | ROE + 5% |

| ROE (30% weighting) | Weighted Average Cost of Capital (“WACC”) | WACC + 1-2% | WACC + 3-5% | |

| Cumulative annual growth rate in non-tariff revenue (40% weighting) | Pax growth rate | Pax growth rate + CPI | Pax growth rate + CPI + 5% | |

| Non-financial performance conditions (40% weighting) | Transformation (35% weighting) ASQ (35% weighting) |

48% 4,1 |

59% 4,3 |

70% ≥4,5 |

| Reputational index (30% weighting) | 60 | 65 | ≥70 |

The LTI cash plan rules will be made available upon request

Fair and responsible remuneration

We are focused on ensuring that fair and responsible remuneration remains a top priority. The values that we drive through our fair and responsible remuneration philosophy are:

- Promoting employment equity;

- Job creation;

- Equal pay for work of equal value;

- Minimising the gender gap in leadership

- roles/Group-wide.

The factors that are considered to ensure that the Group remunerates fairly includes, but are not limited to, the following:

- Individual performance;

- Financial profitability of the Group;

- Economic environment;

- Market pay benchmarking.

Termination of employment

To determine how an employee or executive’s incentives are handled upon termination of employment, we have determined two categories of termination of employment, i.e. good leavers and bad leavers.

Good leavers are employees/executives whose employment was terminated due to no fault of their own, including but not limited to: death, retrenchment, ill-health, injury, retirement, disability or change in control. Employees/executives whose employment is terminated as a result of any of the above reasons will qualify for a pro-rata share in the STI and LTI based on the number of months served under the financial year and the performance conditions that have been met.

Bad leavers are employees/executives whose employment was terminated for any other reason than ‘good leaver’. Employees, executives whose employment is categorised as a bad leaver will forfeit all rights to LTIs and STIs.

Malus and clawback

The Board has the discretion to apply malus or clawback to any incentive award made under its remuneration policy at the occurrence of certain trigger events. In terms of the Group’s malus and clawback policy the following events can be described as triggered events, but should not be seen as an exhaustive list: -

- the discovery of a material misstatement resulting in an adjustment in the audited consolidated accounts of the Group or the audited accounts of any member of the Group; and/or

- the assessment that any Performance Condition(s) or condition was based on error, or inaccurate or misleading information; and/or

- the discovery that any information used to determine the amount of an incentive award was based on error, or inaccurate or misleading information; and/or

- action or conduct of an employee which, in the reasonable opinion of the Board, amounts to employee misbehaviour, fraud or gross misconduct; and/or

- events or behaviour of an employee have led to the censure of a member of the Group by a regulatory authority or have had a significant detrimental impact on the reputation of any member of the Group, provided that the Board is satisfied that the relevant employee was responsible for the censure or reputational damage and that the censure or reputational damage is attributable to him/her.

Executive employment contracts

The following are the types of employment contracts which will be offered to executives:

- The CEO and CFO will be appointed on a five (5) year fixed-term contract in line with the Memorandum of Incorporation (MOI) and the Board of directors’ recommendation to the Minister of Transport for approval.

- The executives will be appointed on permanent basis by the CEO.

- The employment contracts for executives on fixed-term contract will have a six (6) month probation period while executives on the permanent employment contract will have a three (3) month probation period. Fixed-term and permanent executives will be eligible for guaranteed pay, short-term performance bonus (where the key performance areas will be determined and evaluated annually) and long-term incentives (where performance conditions will be measured over a rolling three (3) year period).

- Permanent employment contracts until the retire-ment age of 60 years.

Non-executive directors

The non-executive directors’ (“NED”) service contracts are for a period of three (3) years and the

NED fees are determined through a special resolution approved by shareholders based on recommendation from the Minister of Transport. The NEDs do not participate in our variable pay schemes and are remunerated on a retainer basis with specified meeting and ad hoc fees. The Group’s policy precludes the payment of termination benefits to directors.

Non-executive director fees are benchmarked using the same JSE-listed peer group as for the executives. This is generally performed once every two years.